Quick visualisations of Australian government tax and spending to provide context to the 2022 federal election.

In 2019-2020, Australia's governments collected about AUD$552 billion in tax and spent about AUD$578 billion.

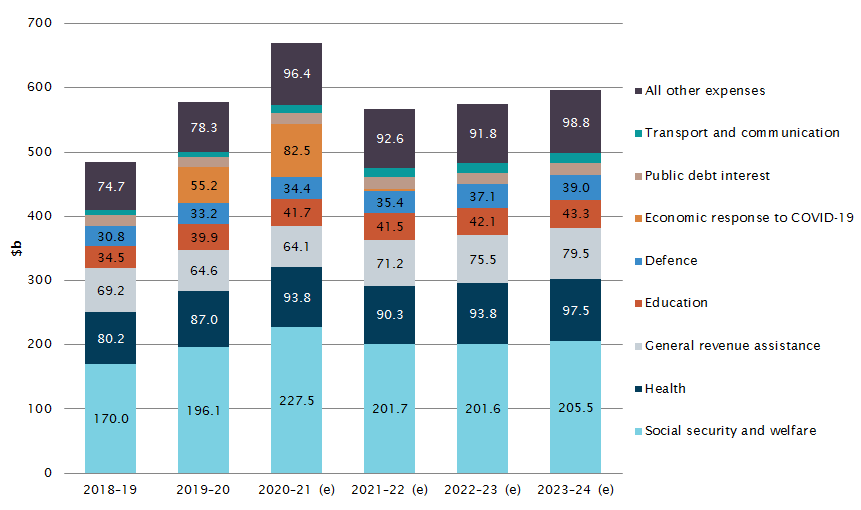

Even before COVID-19, Australia consistently spent the most on social security/welfare and health. (2021-2022 on are projections).

'General revenue assistance' refers to transfers of GST to the States.

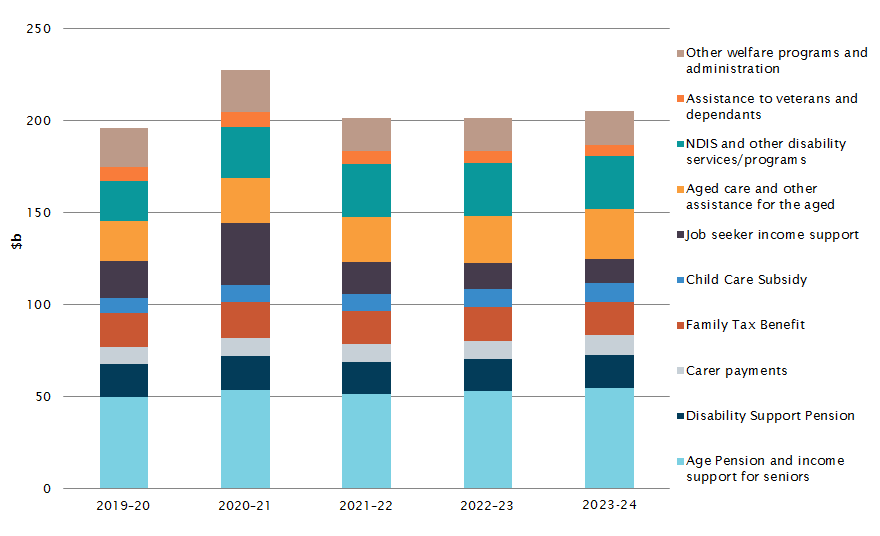

Because Social Security and Welfare is the biggest item, just over a third of spending, let's break it down further. (2021-2022 on are projections).

Excepting the temporary hike in JobSeeker due to COVID-19, the biggest expense items were limited to the aged: the aged pension and aged care.

Indeed, older Australians receive the most income support. (Source: RBA)

However, other benefits and social transfers to other age cohorts somewhat make up for the disparity.

Despite its much smaller cost unemployment income support (JobSeeker) is widely perceived (and portrayed) as a handout to bludgers, and initiatives like Robo-debt reinforce the image of the Government stewarding taxpayer dollars by being vigilant to fraud. In contrast, benefits to the aged are cast as the just reward for years of tax contributions, despite this having a false basis, hence resistance to the 'rightfully earned' aged pension being managed at the individual level or reviewed at the budget level.

What does this have to do with spending? Spending priorities, like taxing priorities, reflect government attitudes, which in a representative democracy reflect the attitudes of voter districts. Though arbitrary, inconsistent, and containing of double-standards, such popular reasoning around who deserves public assistance is hard to question because of its momentum. The status quo was set by the fears and beliefs of the demographically powerful, and governments will tread lightly if the forces behind that status quo are still active going into an election.

TLDR: The very large sacred cow of aged welfare spending will likely not arise in this election save for the foregone conclusion that it must be paid for somehow.

How?

Let's move on to revenue.

Total Tax Revenue, all levels of government, 2019-2020

Unsurprisingly, income tax cuts are politically popular, but risk eroding the largest revenue source.

Diversification through increasing other taxes is an option, but if tax reform was easy, it would have already been done.

For every tax that could be expanded there are political reasons why this hasn't happened.

Take land taxes. There are plenty arguing for higher and broader-based land taxes, particularly to replace stamp duty. But the benefits will bypass the federal government for state coffers. Furthermore, they will disadvantage the more numerous older voters who tend to own homes.

As with spending, if the voter forces behind these tax policies are still in play, do not expect election candidates to challenge them.

All that said, revenue from land taxes have actually increased substantially and surreptitiously over the 5 years to 2020-2021.

And despite rhetoric about cutting income taxes, they have made up an increasing share of tax revenue over the same period.

There could be an exogenous shock, like COVID-19, that radically changes priorities. However, like COVID-19's effect on unemployment benefits, that change may not stick.

So the probability is that spending on the old will increase, as will reliance on income tax to fund it.

What will election rhetoric look like?

Expect 'aged' to be equated with vulnerability, notwithstanding the growing ranks of self-funded retirees. This normalises the focusing of welfare spending in that area, above others.

Also expect conversation around returning people to (private sector) work rather than other reforms.

Comments

Post a Comment