| |

| Same again tomorrow. |

One thing I like to tell myself during bear markets:

On any given trading day, three quarters of a percent of the U.S. market turns over.

This figure varies by up to a third a year. Other markets, like Australia, report lower volumes (55%-85% p.a.). Few countries post higher.

From the sound and fury of that 0.75% comes daily stock prices, index numbers, portfolio valuations, and my sense of self-worth.

That's context to the so-called 'intelligence' and 'efficiency' of the market. My dad always said of investing, "Don't follow the herd," but in fact rumours of its movements are greatly exaggerated.

Assuming algorithmic trading comprises 60% in market cap as well as volume, human trades would sit around 0.3% daily turnover.

Assuming separation between humans and computers, and distributions of capitalisation matching volume, 0.15% of investors are selling out.

So, headlines of "Blood on the Trading Floor": 0.15%.

"Bearish Investors flee to Cash": 0.15%.

Of course, there's a buy side to every sell side, so 0.15% of investors are also buying in.

"Bulls Rally for a Piece of the Action": 0.15%.

99.25% of the herd sat perfectly still today.

So "the market fell 1%" is misleading. It re-values the entire market based on the day's closing trades.

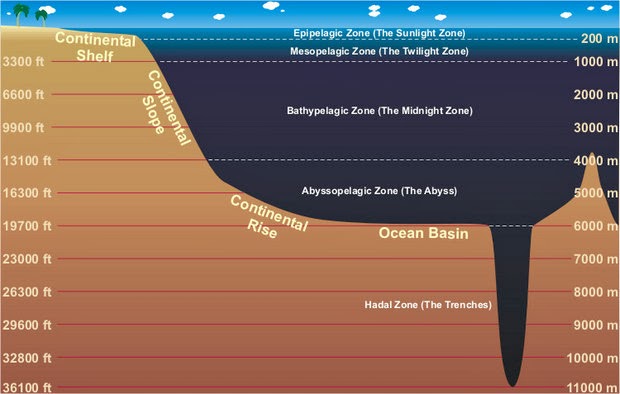

My wife thought of a great analogy: the ocean. Most of it is like this:Dark, still, and to be honest, kind of dull, except for whales calling each other and plankton going about the business of eating each other.

But commentary paints it like this:

Swells, sharks, shipwrecks, oh my!

It's true that turbulence could kill you, but you can't look at the surface and imagine it's the same all the way down.

The secret is that you only need to worry about chop at the interface between air and water, i.e. when buying and selling. Even then, you're (hopefully) not going to be plunging in or pulling out entirely.

Comments

Post a Comment